New Delhi: Union Finance Minister Nirmala Sitharaman presented her record ninth consecutive Union Budget for 2026-27 on Sunday, framing it as a Yuva Shakti-driven blueprint for Viksit Bharat. Anchored in three “kartavyas” — accelerating economic growth, fulfilling aspirations, and ensuring inclusive access — the budget prioritizes manufacturing scale-up, infrastructure momentum, sectoral skilling, and fiscal discipline amid global volatility, U.S. tariffs, and supply-chain disruptions.

While the government and industry bodies hailed the focus on long-term resilience, oppositions argue the budget represents a cautious, incremental exercise that avoids bold reforms, fails to meaningfully boost consumption or private investment, and falls short of addressing immediate economic pain points such as sluggish job creation, rural distress, and declining household demand.

Fiscal Discipline Over Stimulus

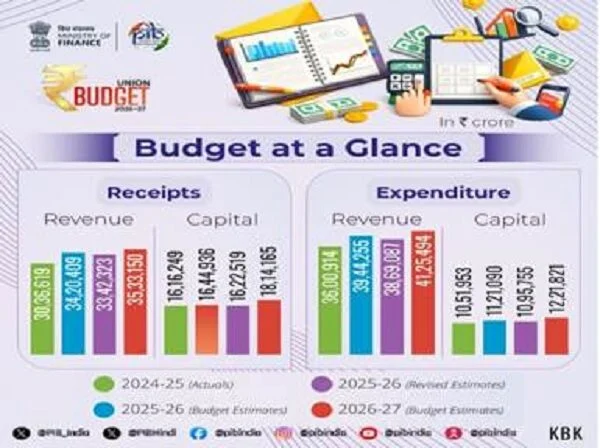

The budget maintains a tight fiscal stance, targeting a fiscal deficit of 4.3% of GDP in 2026-27 (down marginally from 4.4% in RE 2025-26) and a debt-to-GDP ratio of 55.6% (from 56.1%). Public capital expenditure rises to ₹12.2 lakh crore (3.1% of GDP), continuing the infrastructure-led growth strategy. Total expenditure is estimated at ₹53.5 lakh crore, with non-debt receipts at ₹36.5 lakh crore.

Rating agencies noted the slowing pace of consolidation, with Fitch observing that further deficit reduction is becoming difficult without compromising GDP growth. The Economic Survey had earlier called for fiscal flexibility given geoeconomic uncertainties, yet the budget opts for prudence — a choice some analysts describe as “no fiscal adventurism” but others see as overly conservative in a year requiring stronger demand support.

Manufacturing and Infrastructure Push — Strong on Intent, Execution in Question

Key announcements include:

- Biopharma SHAKTI (₹10,000 crore over five years) to build biologics capacity.

- Integrated textile programme covering fibres, clusters, handlooms, sustainability, and skilling.

- ₹10,000 crore SME Growth Fund to create “Champion MSMEs”.

- Seven high-speed rail corridors, new freight corridors, 20 national waterways, and City Economic Regions funding.

These measures aim to counter U.S. tariffs’ impact on labour-intensive exports and strengthen strategic sectors. Industry welcomed the MSME fund as a “game-changer” and the capex continuity.

However, past PLI schemes and export promotion missions have faced implementation delays. Critics question whether the scattershot sectoral incentives — without major new consumption boosters — can sufficiently revive private investment or offset export pain in textiles, leather, and gems & jewellery.

Tax Measures: Procedural Cleanup, No Big Relief

Direct tax reforms include the New Income Tax Act, 2025 (effective April 2026), simplified forms, lower TCS rates (overseas education/tours/medical to 2%), rationalized TDS, and safe harbour enhancements for IT services. Buyback taxation shifts to capital gains, MAT rate drops to 14%, and incentives attract data centres and global talent.

Indirect tax changes focus on export competitiveness (duty exemptions for marine/leather/textile inputs, critical minerals, aviation components) and personal imports (reduced rates, more rare disease exemptions).

While procedural easing is appreciated, the absence of broad-based personal or corporate tax relief disappointed middle-class and consumption-driven expectations. The hike in STT on futures (to 0.05%) and options (to 0.15%) drew criticism from traders for potentially dampening market participation.

Social Sector and Inclusion: Incremental Steps Amid Cuts

Announcements cover medical tourism hubs, veterinary expansion, AVGC labs in schools/colleges, girls’ hostels in STEM districts, Khelo India Mission, Bharat-VISTAAR AI tool for farmers, SHE Marts, mental health upgrades, and North-East Buddhist circuits.

Yet opposition voices and analysts highlighted substantial cuts in rural development (₹53,000 crore reduction), Jal Jeevan Mission spending, and several centrally sponsored schemes — totaling around ₹1.2 lakh crore less in key social sectors. Critics argue this reflects a continued tilt toward corporates and infrastructure at the expense of rural India, agriculture, health, and education — areas critical for reviving broad-based demand and addressing multidimensional poverty reversal risks.

Verdict: Credible Stability or a Budget of Caution and Compromise?

Supporters view the budget as “credible and creditable” — a mature response that avoids populism, reinforces macro stability, and lays groundwork for resilient manufacturing and services-led growth in a turbulent world.

Detractors call it a “missed opportunity” — short on big-bang reforms, consumption stimulus, or bold foreign investment signals, leaving the economy reliant on public capex amid weak private demand, high youth unemployment, and external headwinds.

As India navigates global protectionism and domestic slowdown concerns, the real test lies in swift implementation and whether incremental measures can translate into sustained momentum — or whether the caution of 2026-27 will be remembered as a year of consolidation rather than acceleration.